Live Dow Jones & Nasdaq Futures: Your Daily Guide\n\nHey there, folks! Ever wonder what drives the stock market even before the opening bell rings? You know, those numbers flashing across your screen, giving you a sneak peek into how the trading day might unfold? Well, you’re probably looking at

Dow Jones and Nasdaq futures live today

. These aren’t just arcane financial terms; they’re

critical indicators

that savvy investors, day traders, and even casual observers like us keep a close eye on. When you hear about

CNN

reporting on the market’s pulse, these futures are often at the heart of their coverage, providing real-time insights into the potential direction of the major U.S. stock indices. Understanding these futures is like having a crystal ball, albeit a somewhat cloudy one, for the next trading session. They reflect sentiment, news, and economic data, all distilled into easily trackable numbers.\n\nFor many of us, the stock market can feel like a complex beast, but breaking it down into manageable chunks, like focusing on

Dow Jones and Nasdaq futures live today

, makes it far less intimidating. These futures contracts essentially represent agreements to buy or sell a specific asset (in this case, an index like the Dow or Nasdaq) at a predetermined price on a future date. While actual trading on the main exchanges like the NYSE or Nasdaq happens during specific hours, futures trade almost around the clock, offering a continuous gauge of investor mood. This continuous trading allows market participants to react to overnight news, global economic developments, or major corporate announcements

before

the regular trading day begins. Imagine a massive global marketplace where everyone is placing their bets on what tomorrow will bring, and these futures are the scoreboard! It’s super important to remember that while futures can be strong predictors, they’re not infallible. They are, however, incredibly valuable tools for

setting expectations

and

understanding potential market volatility

. This article is all about demystifying these powerful financial instruments, explaining

why

they matter,

how

to interpret them, and

where

to get reliable, live updates, especially from trusted sources like CNN. So, buckle up, guys, because we’re diving deep into the world of pre-market indicators! We’ll explore the unique characteristics of both the Dow Jones Industrial Average futures and the Nasdaq 100 futures, highlighting what makes each of them a distinct and vital barometer for different segments of the economy. From manufacturing giants to tech innovators, these futures tell a comprehensive story of market anticipation.\n\n## Understanding Stock Market Futures: Why They Matter to You\n\nLet’s kick things off by really digging into what

stock market futures

are and

why they matter so much

to us, whether we’re seasoned investors or just trying to make sense of the daily news. At its core, a

futures contract

is a legal agreement to buy or sell something—anything from commodities like oil and gold to financial instruments like stock indices—at a predetermined price at a specified time in the future. Now, when we talk about

Dow Jones and Nasdaq futures live today

, we’re specifically referring to futures contracts tied to the performance of these major stock market indices. These contracts trade on specialized exchanges, often for extended hours outside of the traditional stock market session, which makes them incredibly valuable for tracking pre-market sentiment. Think of them as a highly sensitive barometer, constantly reacting to global events, economic data releases, and company-specific news even when the main stock market is closed. This extended trading window provides an early warning system, giving us a heads-up on how the market might open and perform once the regular trading hours begin.\n\nThe primary reason

why these futures matter

boils down to their function as a

leading indicator

. Imagine waking up to major news, like a surprise interest rate hike or a geopolitical event. Before the actual stock market opens, traders and institutions will react to this news by buying or selling futures contracts. If the news is positive, you’ll likely see

Dow Jones and Nasdaq futures

climbing, signaling a potential upward open for the broader market. Conversely, negative news can send futures tumbling, indicating a weaker start. This pre-market activity gives us a

crucial glimpse

into the collective investor sentiment. For day traders, this is gold; it helps them strategize their first moves of the day. For long-term investors, it offers context for why their portfolio might be up or down at the opening bell. It’s not just about predicting the open, though. Futures can also hint at ongoing trends and the market’s underlying strength or weakness throughout the day. For instance, strong positive futures can indicate a robust appetite for risk, while consistent declines might signal caution.

Understanding these dynamics

is key to making informed decisions and not being caught off guard when the market opens.\n\nMoreover, these futures provide a vital mechanism for

hedging risk

. Large institutional investors and fund managers use futures to protect their existing stock portfolios from adverse price movements. If they foresee a downturn, they might sell futures contracts to offset potential losses in their actual stock holdings. This institutional activity, in turn, influences the prices of the futures contracts themselves, making them even more representative of broader market expectations. For the individual investor, while you might not be directly trading futures,

monitoring them

gives you invaluable insight into the thinking of these major players. It’s like peeking into the minds of the big wolves of Wall Street! The sheer volume of trading in these futures markets also adds to their significance. Billions of dollars worth of these contracts change hands daily, meaning their prices are not easily manipulated and tend to reflect genuine supply and demand dynamics. So, the next time you see CNN or another financial news outlet reporting on the \“pre-market action\” or \“futures pointing higher/lower,\” know that they’re talking about these powerful indicators that offer a window into the market’s soul

before

the main event even begins. It’s about being prepared, guys, and these futures are your early warning system. They help you anticipate, rather than just react, to the volatile world of stocks, making you a more informed and, hopefully, more successful market participant. Don’t underestimate their power!\n\n## The Dow Jones Industrial Average (DJIA) Futures: A Closer Look\n\nAlright, let’s zoom in on one of the grandfathers of the stock market: the

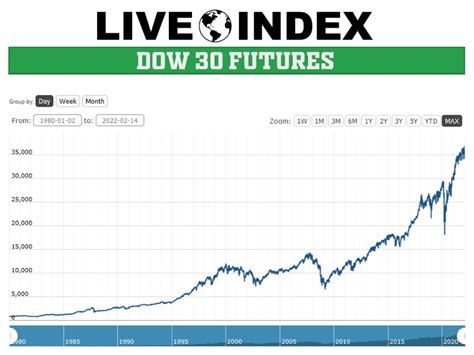

Dow Jones Industrial Average (DJIA) futures

. When we talk about

Dow Jones futures live today

, we’re referring to contracts that track the performance of the Dow Jones Industrial Average itself. The DJIA, for those who might not know, is an index that comprises 30 large, publicly-owned companies traded on the New York Stock Exchange and the Nasdaq. It’s one of the oldest and most widely recognized stock market indices in the world, often seen as a bellwether for the overall health of the U.S. economy, particularly its industrial and traditional corporate sectors. While it only represents 30 companies, these are often

household names

and titans of their respective industries—think Apple, Boeing, McDonald’s, Coca-Cola, and Visa. Because of its composition, the Dow futures give us a really good sense of how these massive, established companies are expected to perform, which in turn provides a strong pulse check on the broader economy. Changes in Dow futures often reflect investor sentiment concerning global trade, manufacturing output, corporate earnings from these large firms, and consumer spending trends.\n\nSo, how do

Dow Jones futures

work? Essentially, traders are betting on the future value of the DJIA. If they believe the 30 companies in the Dow will, on average, perform better, they’ll buy Dow futures contracts. If they anticipate a downturn for these industrial giants, they’ll sell. This constant buying and selling, driven by

expectations

and

reactions to news

, creates the real-time price movements we track when we look at

Dow Jones futures live today

. The contract specifications mean that each point movement in the futures price translates to a specific dollar amount, making these instruments quite powerful for leverage, which is why institutions love them. The factors influencing Dow futures are incredibly diverse. We’re talking about everything from quarterly earnings reports of Dow components to macroeconomic data like GDP growth, inflation figures, and employment reports. For example, a strong jobs report might lead to an immediate jump in Dow futures as investors anticipate increased consumer spending and corporate profits. Conversely, concerns about rising interest rates could put pressure on these growth-sensitive stocks, causing Dow futures to dip. Geopolitical events, shifts in commodity prices, and even major policy announcements from Washington can all have a direct and often immediate impact.\n\nWhat’s really fascinating about

Dow Jones futures

is their

historical significance

and the weight they carry. For over a century, the Dow has been a proxy for the American capitalist spirit. While some critics argue that its price-weighted methodology (where higher-priced stocks have a greater impact) isn’t as representative as other market-cap-weighted indices, its psychological importance and widespread recognition are undeniable. When you hear about \“the market\” on the news, often the Dow is the first index mentioned. Tracking its futures allows you to see how that sentiment is shaping up

before

the main trading action. It’s especially useful for understanding the health of sectors like industrials, financials, and consumer staples, which are heavily represented within the DJIA. A strong rally in Dow futures might indicate optimism about the traditional economy, perhaps spurred by infrastructure spending plans or strong retail sales data. Conversely, if Dow futures are lagging, it could signal concerns about economic slowdowns or pressures on established corporate giants. Always remember, guys, while the Dow is a fantastic indicator, it’s just one piece of the puzzle. It’s best viewed alongside other indices like the Nasdaq to get a truly comprehensive picture. Its movements are often less volatile than the tech-heavy Nasdaq, reflecting the more mature, stable nature of its constituent companies. Keep an eye on the big names within the index; their individual news can often ripple through the entire Dow futures market, giving us valuable clues about the day ahead.\n\n## Navigating the Nasdaq 100 Futures: The Tech Pulse\n\nNow, let’s shift our focus from the industrial titans to the innovation powerhouses: the

Nasdaq 100 futures

. When you’re looking at

Nasdaq futures live today

, you’re essentially getting a real-time read on the future performance of the Nasdaq 100 index. This index is a big deal, especially for anyone interested in technology, growth stocks, and the cutting edge of the economy. Unlike the Dow, which is broader and includes traditional industries, the Nasdaq 100 is

heavily concentrated in technology and growth companies

. We’re talking about giants like Apple, Microsoft, Amazon, Google (Alphabet), and Tesla, alongside many other innovative firms across various sectors like retail, biotechnology, and industrials, but excluding financial companies. This tech-centric composition makes Nasdaq futures a particularly

sensitive barometer

for investor sentiment towards innovation, future earnings potential, and overall risk appetite in the market. If you want to know what the tech world is thinking, then tracking the Nasdaq 100 futures is absolutely essential. Its movements can often be more volatile than the Dow’s, reflecting the often rapid and sometimes unpredictable nature of the tech sector.\n\nSo, how exactly do

Nasdaq futures

function, and what drives their price movements when we monitor

Nasdaq futures live today

? Much like Dow futures, these are contracts where traders agree to buy or sell the Nasdaq 100 index at a set price on a future date. If there’s good news for the tech sector—say, a breakthrough in AI, a stellar earnings report from a major tech company, or positive analyst upgrades—you’ll often see Nasdaq futures surge. Conversely, concerns about regulations, rising interest rates (which can hit growth stocks particularly hard by making future earnings less valuable), or disappointing tech earnings can send these futures downward quickly. The

key drivers

for Nasdaq futures are often tied to global technological trends, corporate innovation, and investor appetite for risk. Unlike the Dow, which might react more to traditional economic indicators, Nasdaq futures are keenly attuned to news related to software, semiconductors, e-commerce, cloud computing, and biotech. Think about it, guys: if a major tech company announces a new product that’s set to revolutionize an industry, you can bet that Nasdaq futures will reflect that excitement almost immediately, even before the market officially opens.\n\nThe

Nasdaq 100 futures

are incredibly important for several reasons. Firstly, they represent the pulse of the

growth-oriented segment

of the market. Many investors look to tech stocks for future capital appreciation, and the Nasdaq 100 is the leading indicator for this segment. Secondly, due to the high-growth nature of its constituent companies, Nasdaq futures can sometimes exhibit

greater volatility

than other index futures. This means bigger swings, both up and down, offering both greater potential rewards and risks for futures traders, and providing more dramatic signals for market watchers.

Monitoring these movements

gives you an immediate read on how investors are feeling about the future of innovation and high-growth sectors. If Nasdaq futures are significantly outperforming Dow futures, it might indicate a \“risk-on\” environment where investors are favoring growth over value. If Nasdaq futures are underperforming, it could signal a shift towards more defensive, value-oriented stocks, perhaps due to concerns about economic slowdowns or rising inflation. It’s crucial, guys, to pay attention not just to the direction but also to the

magnitude

of the movements in Nasdaq futures. A slight dip might be noise, but a significant decline could signal a broader change in sentiment for the tech world. Staying updated on news specifically impacting the tech giants and emerging innovators within the Nasdaq 100 is your best bet for understanding and predicting the movements of these dynamic futures contracts.\n\n## How CNN Delivers Live Futures Updates: Your Go-To Source\n\nWhen it comes to staying informed about the fast-paced world of finance, having a reliable source for

live futures updates

is absolutely essential. This is where a major news network like

CNN

truly shines, offering comprehensive coverage of

Dow Jones and Nasdaq futures live today

to millions of viewers and readers. CNN’s financial reporting arm, often seen on CNN Business, provides a constant stream of information that helps both professional traders and everyday investors make sense of market movements

before

the traditional trading day even begins. They understand that the market doesn’t wait for the opening bell, and neither should you. By delivering real-time data, expert analysis, and breaking news, CNN becomes a critical tool in your market monitoring arsenal. They don’t just show you the numbers; they contextualize them, explaining

why

futures are moving the way they are and what that might mean for your investments. This focus on

context and analysis

is what sets a high-quality news source apart from a mere data feed.\n\nSo,

what kind of information

can you expect from CNN when tracking

live futures updates

? Typically, CNN will present the current prices of Dow Jones Industrial Average futures and Nasdaq 100 futures, along with their absolute change in points and percentage change from the previous day’s close. But they go beyond just raw numbers. You’ll often find accompanying articles or on-air segments discussing the

catalysts

behind these movements. Did a major economic report just come out? Did a prominent tech company release an unexpected earnings pre-announcement? Is there significant geopolitical news affecting global trade? CNN’s financial journalists and analysts work tirelessly to connect these dots, providing you with a narrative that explains the market’s reaction. For example, if

Dow Jones futures

are sharply down, CNN might highlight concerns about manufacturing data or a weak corporate outlook. If

Nasdaq futures

are soaring, they might point to a strong performance in the tech sector overseas or optimism around a new technological development. This

curated information

is invaluable because it helps you understand the bigger picture, not just the isolated data points.\n\nThe value of getting these

live futures updates

from a trusted source like CNN cannot be overstated, guys. In a world brimming with information overload, it’s crucial to differentiate between reliable, expertly vetted news and mere speculation. CNN, with its established journalistic standards and global network of reporters, provides that layer of trust and accuracy. They often feature interviews with economists, market strategists, and fund managers who offer diverse perspectives on what the futures movements might signify. This multi-faceted approach helps you form a

well-rounded understanding

of the market’s dynamics. Furthermore, CNN’s digital platforms and television broadcasts ensure that these updates are accessible across various channels, whether you’re at your desk, commuting, or on the go. They integrate charts, graphs, and historical data to illustrate trends, making complex financial concepts more digestible. For anyone serious about staying ahead of the curve in the stock market, actively following how CNN interprets and presents

Dow Jones and Nasdaq futures live today

is a smart move. It’s about being informed, being prepared, and having the insights you need to navigate the financial landscape with confidence. Don’t just look at the numbers;

understand the story behind them

, and CNN is excellent at telling that story.\n\n## What to Look For When Tracking Futures Live Today\n\nAlright, guys, you’re tracking

Dow Jones and Nasdaq futures live today

, and you’ve got your trusted news source, like CNN, feeding you the latest numbers. But how do you make sense of it all? What are the

key things to look for

that will give you the most valuable insights into the upcoming trading day? It’s not just about seeing if the numbers are green or red; it’s about interpreting the

magnitude

, the

context

, and the

drivers

behind those movements. First and foremost, pay attention to the

magnitude of the change

. A slight fluctuation of a few points might just be normal pre-market noise. However, if you see

Dow Jones futures

or

Nasdaq futures

moving hundreds of points (or a significant percentage, say 0.5% or more) in either direction, that’s a strong signal. Large movements indicate significant institutional buying or selling pressure and a high conviction among traders about the market’s direction.

Big swings

often precede a volatile or trending day in the actual stock market, so these are crucial to note. They scream, \“Something significant happened, or is expected to happen!\”\n\nNext, consider the

trading volume

. While not always prominently displayed on basic news feeds, high trading volume accompanying a price movement in

Dow Jones and Nasdaq futures

adds credibility to that movement. Low volume movements can sometimes be misleading, as they might be easily reversed once more participants enter the market.

High volume

indicates broad participation and stronger conviction, suggesting the move is more likely to sustain. Think of it this way: a few people shouting in a room isn’t as impactful as a stadium full of fans cheering or booing. The more \“fans\” (traders) participating, the more weight the futures movement carries. Another critical element is

news catalysts

. As we’ve discussed, futures react instantly to breaking news. So, when you see a sharp move in

Dow Jones and Nasdaq futures live today

, immediately ask yourself:

What news just broke?

Was it a significant economic data release (inflation, jobs, GDP)? A major corporate earnings report, particularly from a bellwether stock within the Dow or Nasdaq? A geopolitical event? An announcement from the Federal Reserve?

Connecting the dots between news and futures movements

is perhaps the most important skill in interpreting these indicators. CNN, for example, excels at highlighting these direct relationships, making it easier for you to understand the \“why\” behind the \“what.\”\n\nFurthermore,

always look at both Dow Jones and Nasdaq futures in conjunction

. These two indices often tell slightly different stories about different segments of the economy. If

Dow Jones futures

are strong but

Nasdaq futures

are weak, it might indicate a sector rotation—investors moving out of growth/tech and into more value-oriented, traditional stocks. Conversely, if Nasdaq futures are outperforming the Dow, it suggests a \“risk-on\” environment where tech and growth are favored.

Understanding this relative strength or weakness

between the two can give you deeper insights into market sentiment and potential sector leadership for the day. For example, if both are significantly up, it’s a broad risk-on move. If both are significantly down, it’s broad risk-off. But differing movements signal more nuanced dynamics. Finally, be mindful of

support and resistance levels

. Experienced traders often watch technical levels where futures prices tend to bounce or reverse. While this is a more advanced concept, even a basic awareness that futures prices don’t move in a straight line and can hit \“ceilings\” or \“floors\” can be beneficial. In essence, guys, when tracking

Dow Jones and Nasdaq futures live today

, think of yourself as a detective. You’re looking for clues—magnitude, volume, news, and comparative performance—to build a compelling picture of what the market might do next. Don’t just passively observe; actively analyze and question!\n\n## Your Guide to Mastering Market Insights with Live Futures\n\nSo, there you have it, folks! We’ve taken a deep dive into the fascinating and incredibly important world of

Dow Jones and Nasdaq futures live today

. From understanding what these futures contracts actually are to dissecting their role as critical market indicators, and finally, learning how a trusted source like CNN delivers these vital updates, you’re now equipped with a much clearer picture. We’ve explored how both the

Dow Jones Industrial Average futures

and the

Nasdaq 100 futures

serve as distinct yet complementary barometers for the U.S. economy—the Dow reflecting the pulse of established industrial giants, and the Nasdaq signaling the heartbeat of innovation and high-growth technology.

Staying on top of these pre-market movements

is not just for the pros; it’s a powerful tool for anyone looking to make more informed decisions and feel more confident in navigating the often-turbulent waters of the stock market.\n\nRemember, guys, the market doesn’t wait for the opening bell. The action often begins long before, with traders and institutions reacting to global news, economic reports, and corporate announcements through futures contracts. By closely monitoring

Dow Jones and Nasdaq futures live today

, you gain an invaluable

early warning system

, giving you a significant edge in anticipating market trends and potential volatility. We discussed the importance of looking beyond just the numbers, emphasizing the need to consider the

magnitude of change

, the

accompanying trading volume

, and most crucially, the

news catalysts

that drive these movements. Don’t forget to always compare the performance of Dow futures versus Nasdaq futures to get a nuanced understanding of sector rotations and underlying market sentiment. Whether investors are favoring traditional value stocks or chasing high-growth tech opportunities, the relative performance of these two futures indices will tell a compelling story.\n\nIn a world where information is king, relying on reputable sources like

CNN

for your

live futures updates

ensures that you’re getting accurate, timely, and well-analyzed data. They provide the context and expert commentary necessary to transform raw numbers into actionable insights. So, make it a part of your daily routine: grab your coffee, check the futures, and get a head start on understanding the financial day ahead. This proactive approach will empower you to react thoughtfully rather than impulsively. While futures are powerful predictive tools, always remember they are

indicators

, not guarantees. They reflect current sentiment and expectations, which can shift rapidly. Combine your futures knowledge with a broader understanding of market fundamentals and your personal investment goals. By doing so, you’ll be well on your way to mastering market insights and confidently charting your financial course. Keep learning, keep observing, and keep an eye on those futures, because they truly are your window into tomorrow’s market,

today

. Happy investing, folks!